Reg. CF

Airo A Qualified Opportunity Zone Sponsor

Offering By Airo Capital Management

Project Overview

Airo A Qualified Opportunity Zone Sponsor

3.2x Investment Yield to Investors! Airo Capital Management, Inc. (AIRO) is an innovative and entrepreneurial firm delivering quality diversified investment opportunities in the QOZ market.

AIRO provides professional commercial real estate investment and operating services by achieving superior returns on invested equity and debt that enhances shareholder value and mitigates risk. Our acquisition focus on Opportunity Zones enable investors to benefit from temporary deferral of eligible capital gains, up to a 15% basis step-up on capital gains invested, and a capital gains bill of zero on new gains for investments held 10 years.

We operate throughout the U.S. by drawing on a combination of industry and functional expertise, technology, and alliances. AIRO organizes business, technological, and operational strategies with advanced cooperation from senior legal, tax/accounting, and design professionals, as well as from planning/zoning officials. As a sponsor of investment-grade property acquisitions, we own and quarterback from conception to completion. We are responsible for all transactional aspects, including the negotiation of agreements, authorization of legal documentation, preparation of marketing materials, and the underwriting of equity and debt financing. AIRO also oversees pre-acquisition activities, including due diligence, such as engaging specialists to conduct site and compliance analyses, in addition to facilitating escrow/settlement procedures.

AIRO Fees

AIRO factors in a market-based fees to acquire land and improvements, plus overrides on renovations or new construction. These cover related costs for the extensive process it oversees throughout months of analysis, which includes 1) the efforts of numerous team members and contract professionals, 2) the assumption of underwriting risk, and 3) general project facilitation. Following the acquisition, we earn a Property Management fee from continued oversight of facility renovations, leasing, building maintenance, and custodial operations. In addition, AIRO could receive an asset management fee in connection with ongoing oversight of capital. Finally, AIRO would be entitled to a modest profit based on a tiered performance above certain thresholds (Waterfalls).

Once you join our family of investors, you can depend on professional telephone support, our duty of care, the receipt of quarterly financial reports, plus necessary tax season documentation for your tax/accounting professionals.

With the funds from this raise, investors in Airo Capital Management could make up to $5,000,000 and would provide the resources needed to line up other deals for Airo and it's investors.

BUSINESS HISTORY

AIRO Capital’s Products and Services

|

Product / Service |

Description |

Current Market |

|

Purchase and oversee an investment-grade asset. |

Sponsor pools capital (syndicates) on behalf of tax-motivated qualified investors. |

QOZ transactions exceed billions of dollars. |

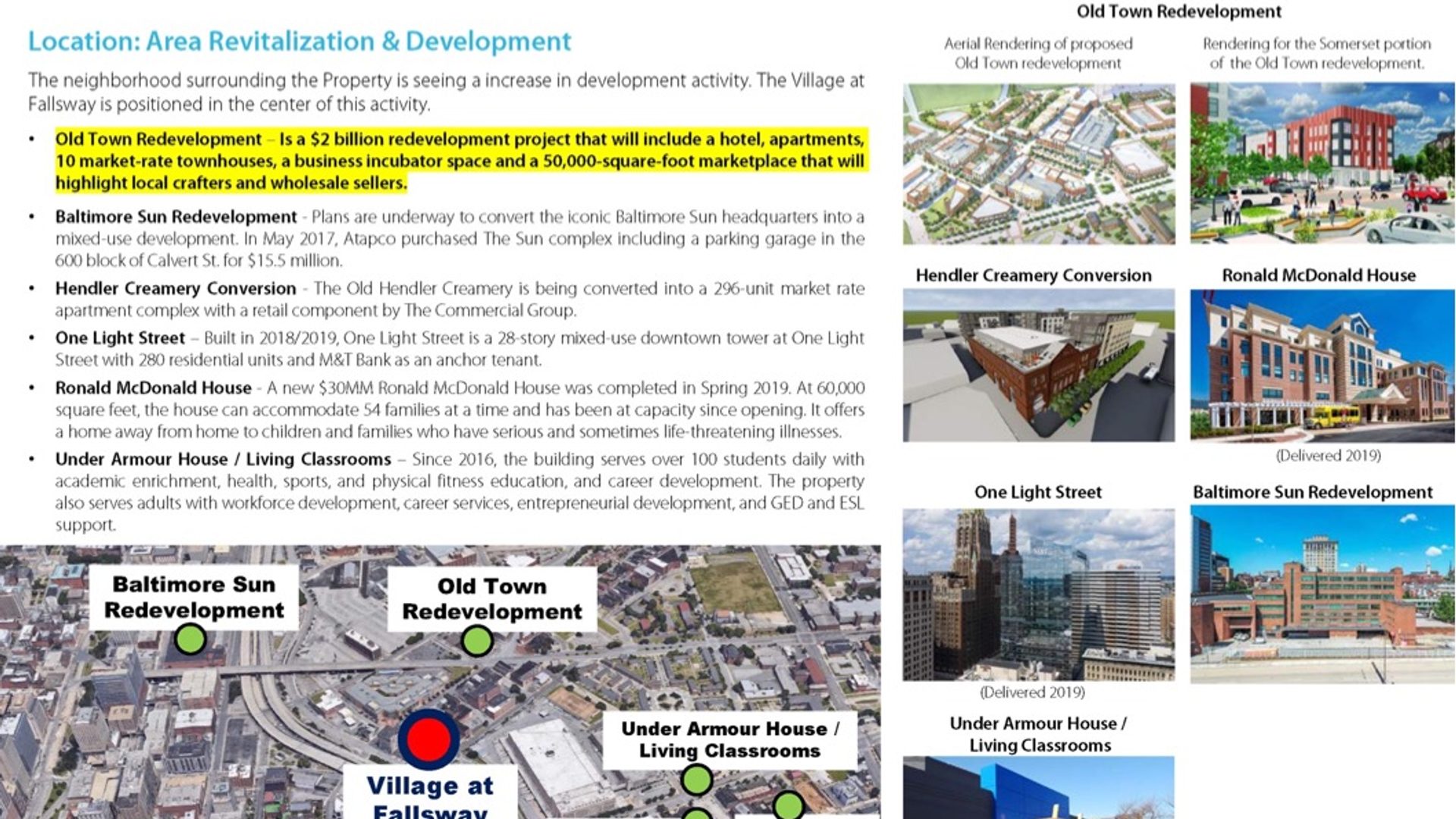

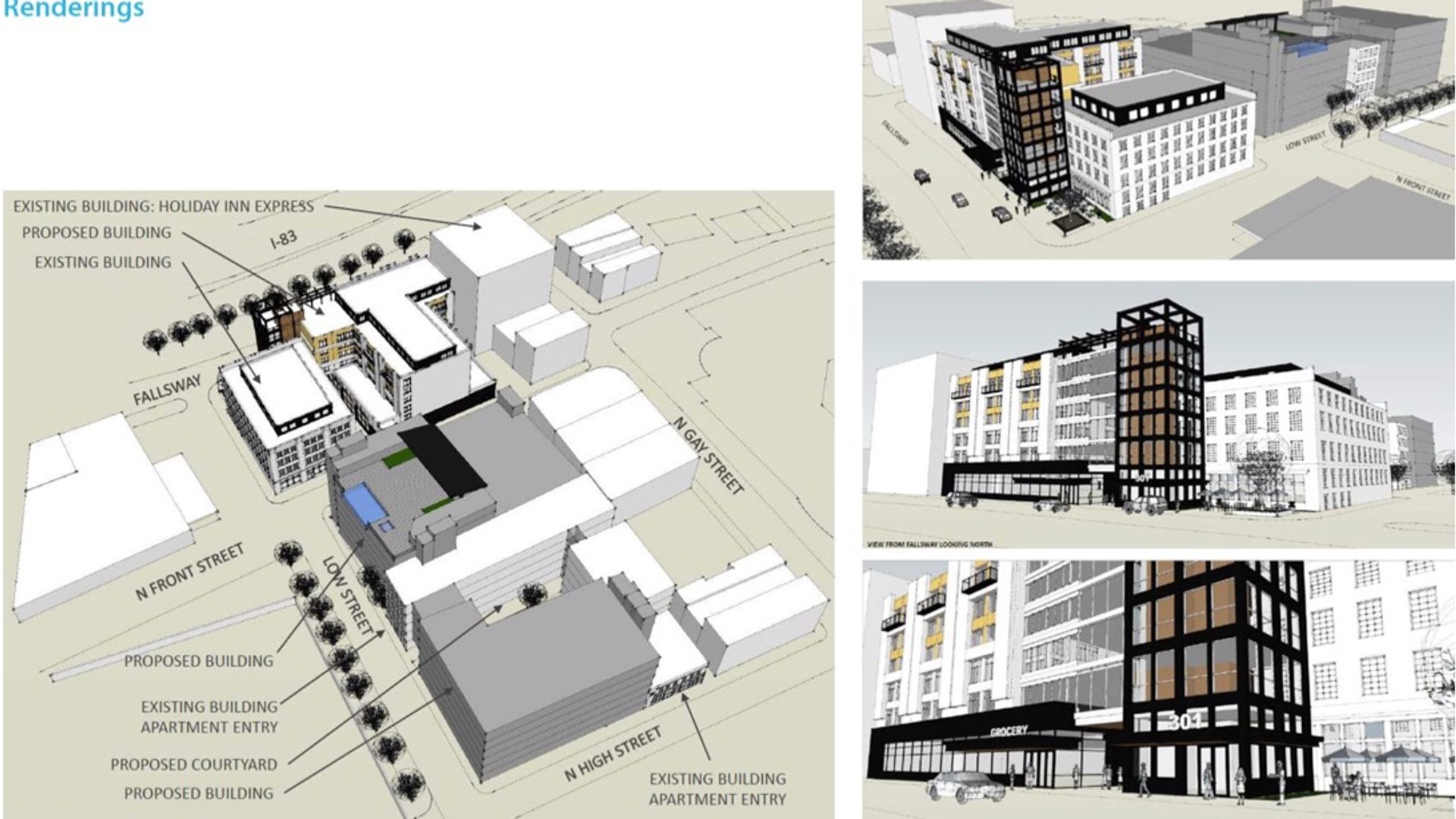

AIRO controls a very large development project in the CBD of Baltimore MD.

We offer our services directly to investors through real estate brokers, direct mail advertising, and our online website.

Competition

AIRO’s primary competitors include REITS with operational focus in the Mid-Atlantic, as well as regional-based real estate Funds.

The markets for AIRO’s products and services are highly competitive and the Company is confronted by aggressive competition. These markets are characterized by well-capitalized companies and under-capitalized companies. The barriers to entry include locating and funding suitable investment-grade assets. The Company’s competitors may aggressively offer more money for possible acquisitions to maintain market share, which reduces their potential profit. Principal competitive factors important to AIRO include price, product quality, design, and situational market factors.

Supply Chain and Customer Base

AIRO continues to be a force to be reckoned with in QOZ markets and has successfully negotiated contracts on several possible targets. Its revenues will be derived primarily from large family offices, REITs, real estate funds or entities looking to protect capital gains in any enterprise.

Regulatory Approval and Compliance

The company is subject to extensive federal, state, and local laws and regulations, including the recently enacted comprehensive tax reform legislation with respect to the treatment of capital gains and QOZs relating to building and zoning requirements. Such laws and regulations are subject to change from time to time. Typically, licenses, permits, and approvals under such tax laws and regulations must be renewed annually, which may be revoked, suspended, or denied for renewal for a cause at any time if governmental authorities determine that conduct violates applicable regulations. Our stated intent is to remain in compliance with all laws, and to this end its operations are overseen by third-party legal and tax professionals.

AIRO conducts business throughout the United States with a Mid-Atlantic market focus.

Because U.S. SEC Form C focuses primarily on information concerning the Company, rather than the industry in which the Company operates, potential purchasers may wish to conduct their own separate investigation of the Company’s industry to obtain greater insight.

Litigation

There are no existing legal suits pending, or to its knowledge, threatened against the Company.

Principal Mailing Address

PO BOX 340, Olney, MD 20830

Indemnification

Indemnification is authorized by the Company to directors, officers, or controlling persons acting in their professional capacity pursuant to Maryland law. Indemnification includes expenses such as attorney’s fees and, in certain circumstances, judgments, fines, and settlement amounts actually paid or incurred in connection with actual or threatened actions, suits, or proceedings involving such person, except in certain circumstances where a person is adjudged to be guilty of gross negligence or willful misconduct unless a court of competent jurisdiction determines that such indemnification is fair and reasonable under the circumstances.

Employees

The Company currently has 3 employees in Maryland.

Valuation

Based on the Offering Price of the Securities, the pre-Offering value ascribed to the Company is $1,000,000.

Before making an investment decision, you should carefully consider this valuation and the factors used to reach such a valuation. Such valuation may not be accurate, and you are encouraged to determine your own independent value of the Company prior to investing.

Directors, Officers, Employees

Frederic S. Richardson, President

Professional Real Estate Experience

- Extensive commercial real estate investment banking experience since 1985, raised $1.5B of debt, equity, and construction financing for private and public projects.

- Chairman and majority shareholder of seven publicly traded companies, owned and operated two national FHA, VA, Full Eagle Mortgage companies, one was taken public in 1999.

- East Coast Realty Ventures (ECRV) hotel properties owned: Fairfield Marriott, Holiday Inn, Clinton Hotel, Astor Hotel.

- ECRV office properties owned: Eagle/Pinnacle Medical Office, Foxcroft Office Buildings.

- Senior Housing ownership/management of Baltimore Apostolic Apartments (102-units).

- Managed a rental conversion to homeownership of 1,200 single-family units utilizing the FHA 203(K) program.

- Controlled 1,000 units of HUD multifamily.

- Rehabilitated 1,000 residential units from Atlanta to Boston.

- Rehabilitated and managed over 1,500 multifamily units in St. Louis, MO.

- Owned over one million square feet of NYC office assets.

- Owned 11 commercial office assets, 2.5M SF in the Southwest, U.S., managed by CBRE.

Past Service | Memberships

Chartered Life Underwriter (CLU), The American College

Member, Building Owners & Managers Association International (BOMA), Apartment & Office Building Association (AOBA)

Member, Alternative and Direct Investment Securities Association (ADISA/TICA)

President Emeritus, Magen David Sephardic Synagogue

John Settles, CEO

John Settles has extensive expertise in real estate development and mortgage banking derived from over 30 years of challenging entrepreneurial and corporate experience.

Senior Vice President, U.S. Mortgage Network (based in Boca Raton, Florida), he has the distinction of being one of the first minority HUD/FHA/VA approved lenders. This specialization enabled him to acquire, develop, construct and finance affordable multi-tenant and single-family housing units throughout the country for elderly and low-income tenants, and other homeowners under the auspices of HUD, FRA, Fannie Mae, and Freddie Mae programs.

- Developed a range of housing types including, apartments, co-ops, and condominiums for adult, senior, and mixed-use developments with both tax-exempt bond financing and low-income tax credits (LIHTC).

- Real Estate Developer and Mortgage Finance Specialist - noted for acquisition, development, construction, and finance of affordable housing utilizing HUD/FHA, Fannie Mae, and Freddie Mac Programs.

- Senior Vice-President of Alliance Housing Partners, LLC – a national affordable multi-family housing developer.

- Built and financed HUD Section 202 housing for the elderly. Initiated multi-family projects and financing under IRS Section 42 Low-Income Housing Tax Credit (LIHTC) programs and Tax-Exempt bonds.

Past Service | Memberships

Current Chairman of the Board of Trustees of a private Montessori school and responsible for the acquisition and construction of the development of its $20M campus.

Past Chair, Board of Trustees for regional community development corporation.

Past Senior Vice-President of U.S. Mortgage Network, Boca Raton, FL.

Past Executive Director, United National Economic Development Action Coalition (UNEDAC). In that role, he represented the largest church denominations across the Nation, directing economic, financial, and community development initiatives.

Chairman, nonprofit development corporation, co-developer of a $22M adult condominium project in Prince Georges County, Maryland.

Terry Burka, Chief Operating Officer

Mid-Atlantic Realty Group/Airo Capital — Washington, DC

High-volume boutique real estate investment firm syndicating securitized multifamily, office, and franchised hotel assets valued between $15M and $120M. Recent emphasis on IRS Qualified Opportunity Zones.

COO, Senior Vice President 02/2008 — Present

- Strategic leader for a $120M IRS Qualified Opportunity Zone ground-up development that generates a pro forma 8% return on equity by incorporating DCF and direct capitalization analytics, as well as appraisal modifications resulting in improvements to land valuation and residual income present values by $7.5M.

- Syndicated $125M in tenant-in-common public equity offerings, $200M CMBS debt originations, and $300M in Life company loans.

- Procured and oversaw $500M in ground-up construction, adaptive reuse rehabilitations, and capital expenditure projects.

- Increased investor confidence by continuously exceeding 8% returns on equity for a $50M hospitality fund and a $65M multi-sector fund comprised of medical office and traditional office assets.

- Inspired professional / personal growth for 3 VPs and 6 Regional Managers. Conducted personal mentoring sessions and quarterly cross-training seminars, as well as annual performance appraisals. Provided team coaching throughout assigned value-add projects.

- Negotiated equity and debt agreement structures and capital stack feasibility while collaborating with senior investment members. Stimulated forward-thinking committee presentations comprised of senior CMBS debt, mezzanine, preferred equity, and 'common' interest equity.

- Saved time and lowered stress by streamlining acquisition processes that reduced procedural disorganization inherent to bidding, contracting, due diligence, escrow and closing procedures.

- Enhanced market value via expedited entitlements-vesting, such as design review, record platting, and early-stage construction improvements by maintaining a congenial working relationship with planning officials, and close cooperation with engineers, General Contractors and superintendents.

- Improved market / balance sheet value by leading strategies that offset capital expenditure accumulated depreciation, that hedged against underestimating working capital, that identified expenses causing unrealistic profit forecasts, and by challenging overly optimistic broker’s revenue assumptions.

- Guaranteed profitability, technical writing advantage, and accountability by drafting standard operating procedures and best practices inherent to competitive bidding, including maintainable revenue assumptions, expense conservation, competitive market and economic feasibility, and growth-based capital expenditures.

Vice President 09/2005 — 02/2008

- Reviewed and authorized asset and regional property managers budgets, as well as reporting models for data integrity, including EOY CAM reconciliations, percentage lease assessments, and renewals. Full P&L drafting and execution accountability.

- Improved multifamily occupancy from 90% to 95%, which increased market value by $52M by converting to in-house leasing processes, and then created a strategy for standardizing prospect contacts / tours that improved closing ratios.

- Recaptured ‘lost rent’ potential by $2.5M or 2.5% per year from lag and loss-to-lease reduction strategies.

Leizear Burka, Inc. — Washington, DC

Principal 06/2001 — 09/2005

Commercial real estate advisory firm offering research services to public REITs and regional developers.

Charles E. Smith Companies — Washington, DC

Largest owner of Class-A multifamily and office properties in the D.C. area; $5B+ market cap.

Then purchased by Vornado Realty Trust | Equity Residential Trust | AvalonBay.

Director 02/1996 — 04/2001

- Directed 2.2M SF Class-A office and retail portfolios comprised of five 15 story (~330K SF) buildings.

- Civilian counterpart for U.S. Pentagon military, DoD contractors, and other Federal / State government agencies, including secured facilities requiring 24-hour engineering services.

- Led a team of 300+ in leasing, engineering, maintenance, and custodial services; oversaw 100 approved-contractors and vendors. Approved capital project procurement and cost reductions.

- Directed 3,300 REIT and fee-managed multifamily apartments with a 5% allocation for corporate housing using a centralized 24/7 tenant relations helpdesk.

- Increased leasing income by 3% by developing strategies that modified approaches to leasing resulting in lowered delinquencies, late charges, general vacancy, vacancy lag, and market loss-to-lease.

- Oversaw capital improvement construction projects, including whole-building rehabilitations, tenant improvements (TIs), garage restorations, and seasonal programs by engineers.

Education

Johns Hopkins University, Baltimore, MD, 2001

M.S., Institutional Real Estate Finance / Investment (Thesis Honors)

University of Maryland

B.S., Business and Management, (Honors)

Licenses | Past Service | Memberships | Software

Real Estate Broker (California, Current)

Expert Witness, U.S. Dist. Court for the District of Columbia; D.C. Court of Appeals

BOMA’s Building Code Commissioner, Appellate Policy Review Board, State of Virginia

Chair, Telecommunications Committee, Building Owners and Managers Association (BOMA)

Corporate Member, Apartment and Office Building Association (AOBA)

Corporate Member, Alternative & Direct Investment Securities Association (ADISA/TICA)

Corporate Member, International Council of Shopping Centers (ICSC)

MS Office, JD Edwards, CoStar, Yardi, AMSI, Hyperion Pillar, RealPage, ARGUS, Crystal Ball

Use of Proceeds

Use of Proceeds

|

Use of Proceeds |

If Minimum Proceeds Raised |

% Minimum |

If Maximum Proceeds Raised |

% Maximum |

|

Total |

$10,000 |

100.00% |

$245,000 |

100.00% |

|

FundMe Expenses |

$550 |

5.50% |

$13,475 |

5.50% |

|

Estimated Attorney Fees |

$1,000 |

10.00% |

$24,500 |

10.00% |

|

Estimated Accountant/Auditor Fees |

$0 |

0.00% |

$24,500 |

10.00% |

|

General Marketing |

$1,000 |

10.00% |

$24,500 |

10.00% |

|

R&D |

$0 |

0.00% |

$0 |

0.00% |

|

General Working Capital |

$7,450 |

74.50% |

$158,025 |

64.5% |

Notes:

- The Use of Proceeds chart above is not inclusive of fees paid to prepare/submit SEC Form C, including the payments to financial and legal service providers, and escrow related fees, all of which were incurred in the preparation of the campaign, and are due in advance of the closing of the campaign.

- Investors may require third-party professionals for additional analysis, which may result in greater costs.

- AIRO has discretion to alter the use of proceeds as set forth above, unless the Board of Directors approves change orders.

Ownership Structure & Rights of Securities

Ownership Structure & Rights of Securities

The Company has issued the following outstanding Securities:

|

Type of security |

Common Stock |

|

Amount outstanding |

1,000,000 Shares |

|

Voting Rights |

Yes |

|

Anti-Dilution Rights |

None |

|

How this Security may limit, dilute or qualify the Notes/Bonds issued pursuant to U.S. SEC Regulation CF |

The Securities will be subject to dilution if/when the Company participates in an equity financing round where investors are offered Common Stock for cash or cash equivalents or if compensatory shares are offered to new or existing shareholders. |

|

Percentage ownership of the Company by the holders of such Securities (assuming conversion prior to the Offering if convertible securities). |

100% |

Risks & Disclosures

Risks & Disclosures

THESE SECURITIES INVOLVE A HIGH DEGREE OF RISK THAT MAY NOT BE APPROPRIATE FOR ALL INVESTORS.

THERE ARE SIGNIFICANT RISKS AND UNCERTAINTIES ASSOCIATED WITH AN INVESTMENT IN THE COMPANY AND THE SECURITIES. THE SECURITIES OFFERED HEREBY ARE NOT PUBLICLY TRADED AND ARE SUBJECT TO TRANSFER RESTRICTIONS. THERE IS NO PUBLIC MARKET FOR THE SECURITIES AND ONE MAY NEVER DEVELOP. AN INVESTMENT IN THE COMPANY IS HIGHLY SPECULATIVE. THE SECURITIES SHOULD NOT BE PURCHASED BY ANYONE WHO CANNOT BEAR THE FINANCIAL RISK OF THIS INVESTMENT FOR AN INDEFINITE PERIOD OF TIME AND WHO CANNOT AFFORD THE LOSS OF THEIR ENTIRE INVESTMENT. SEE THE SECTION OF US SEC FORM C ENTITLED "RISK FACTORS."

PRIOR TO CONSUMMATION OF THE PURCHASE AND SALE OF ANY SECURITY THE COMPANY WILL AFFORD PROSPECTIVE INVESTORS AN OPPORTUNITY TO ASK QUESTIONS OF AND RECEIVE ANSWERS FROM THE COMPANY AND ITS MANAGEMENT CONCERNING THE TERMS AND CONDITIONS OF THIS OFFERING AND THE COMPANY. NO SOURCE OTHER THAN THE INTERMEDIARY HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR MAKE REPRESENTATIONS, EXCEPT PURSUANT TO RULE 501 OF REGULATION CF. INVESTORS SHOULD BE AWARE THAT THEY WILL BE REQUIRED TO BEAR THE FINANCIAL RISKS OF THIS INVESTMENT FOR AN INDEFINITE PERIOD OF TIME.

NASAA UNIFORM LEGEND

IN MAKING AN INVESTMENT DECISION INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE PERSON OR ENTITY ISSUING THE SECURITIES AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED BY ANY FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY. FURTHERMORE, THE FOREGOING AUTHORITIES HAVE NOT CONFIRMED THE ACCURACY OR DETERMINED THE ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

SPECIAL NOTICE TO FOREIGN INVESTORS

IF THE INVESTOR LIVES OUTSIDE THE UNITED STATES, IT IS THE INVESTOR’S RESPONSIBILITY TO FULLY OBSERVE THE LAWS OF ANY RELEVANT TERRITORY OR JURISDICTION OUTSIDE THE UNITED STATES IN CONNECTION WITH ANY PURCHASE OF THE SECURITIES, INCLUDING OBTAINING REQUIRED GOVERNMENTAL OR OTHER CONSENTS OR OBSERVING ANY OTHER REQUIRED LEGAL OR OTHER FORMALITIES. THE COMPANY RESERVES THE RIGHT TO DENY THE PURCHASE OF THE SECURITIES BY ANY FOREIGN INVESTOR.

SPECIAL NOTICE TO CANADIAN INVESTORS

IF THE INVESTOR LIVES WITHIN CANADA, IT IS THE INVESTOR’S RESPONSIBILITY TO FULLY OBSERVE THE LAWS OF A CANADA, SPECIFICALLY WITH REGARD TO THE TRANSFER AND RESALE OF ANY SECURITIES ACQUIRED IN THIS OFFERING.

NOTICE REGARDING ESCROW AGENT

PRIME TRUST, THE ESCROW AGENT SERVICING THE OFFERING, HAS NOT INVESTIGATED THE DESIRABILITY OR ADVISABILITY OF AN INVESTMENT IN THIS OFFERING OR THE SECURITIES OFFERED HEREIN. THE ESCROW AGENT MAKES NO REPRESENTATIONS, WARRANTIES, ENDORSEMENTS, OR JUDGEMENT ON THE MERITS OF THE OFFERING OR THE SECURITIES OFFERED HEREIN. THE ESCROW AGENT’S CONNECTION TO THE OFFERING IS SOLELY FOR THE LIMITED PURPOSES OF ACTING AS A SERVICE PROVIDER.

Previous Funding

Previous Funding

- Holiday Inn Express (159 Rooms, Baltimore, MD)

- Fairfield Marriott (204 Rooms, Atlantic City, NJ)

- Clinton Hotel (88 Rooms, South Beach, Miami Beach, FL)

- Astor Hotel (42 Rooms, South Beach, Miami Beach, FL)

- Eagle Pinnacle Medical Office (170K SF, Atlanta, GA)

- Fox Croft Offices (60K SF, Martinsburg, WV)

- NYC Macy’s warehouse renovation (1,000,000 SF)

- Rhode Island Avenue Plaza, Washington, DC (421 Units)

- San Juan, PR (520 Units)

- Pensacola Plaza, FL (300 Units)

- Vero Beach, FL (125 Units)

- Tucson, AZ (300 Units)

- Virginia Beach, VA (200 Units)

- Odessa, TX (200 Units)

- Cobb County, GA (200 Units)

- Waco, TX (65 Units)

- Lowe Avenue, Chicago (182 Units)

- East St. Louis, IL (275 Units)

- Baltimore, MD (150 Units)

View our

Offering Documents

Meet the Airo A Qualified Opportunity Zone Sponsor team

Chairman, President

Frederic S. Richardson

Frederic has nearly 20 years of real estate investing and securitization experience, and is a Maryland native. He has a BA in Economics from the University of Maryland and and an MBA in Finance from American University - Kogod School of Business.

COO

Terry Burka

Strategist with 20 years of leadership and national asset / acquisitions growth. Leverages industry knowledge to articulate a strategic vision, assess attendant risks, and guide the firm’s growth while remaining apprised of significant developments. Embodies the “tone at the top” while directing $1B real property operations for mid-sized commercial real estate companies concentrating on mixed-use multifamily, office/retail, and hotel assets.

CONSULTANTS

ADVISORS

Third-party Professionals

CEO

John Settles

John Settles has extensive expertise in real estate development and mortgage banking, with a focus on market-based multifamily and workforce housing. John is key to arranging public-private partnerships, such as investment tax credits, job creation tax credits, and other enterprise zone subsidies on the State and City level that transform underutilized areas and drive economic development.